Is Instacart Worth It in 2025? A Comprehensive Breakdown for Shoppers & Drivers

In the whirlwind of 2025, where AI assistants curate playlists and autonomous drones zip through city skies, grocery delivery remains a grounded staple of modern convenience. Instacart, the trailblazing platform that transformed errand-running into a tap-and-deliver affair, now boasts partnerships with over 1,500 retailers and serves 99% of U.S. households. But as economic headwinds like lingering inflation and gig worker saturation buffet the industry, questions loom: Does Instacart’s promise of effortless shopping hold up against escalating fees and unpredictable payouts? With competitors like DoorDash expanding grocery arms and Amazon Fresh leveraging Prime perks, is Instacart still the cart king?

This exhaustive 2025 analysis—drawing from Instacart’s Q2 financials (released August 7, showing 17% YoY order growth), shopper forums on Reddit, real-time X anecdotes, and industry reports—dives deep. We’ll explore the customer side: time-saving wizardry versus markup mayhem. For drivers (Instacart’s “shoppers”), we’ll dissect earnings volatility amid the May 2025 Shopper Agreement overhaul. Expect granular breakdowns, pro tips, comparative charts, and unvarnished user stories. By the end, you’ll know if Instacart fits your lifestyle—or if it’s time to switch lanes. As one X user quipped amid a substitution saga: “Guess I’m finna make some lemonade.” Let’s roll.

The Evolution of Instacart: From Startup to 2025 Powerhouse

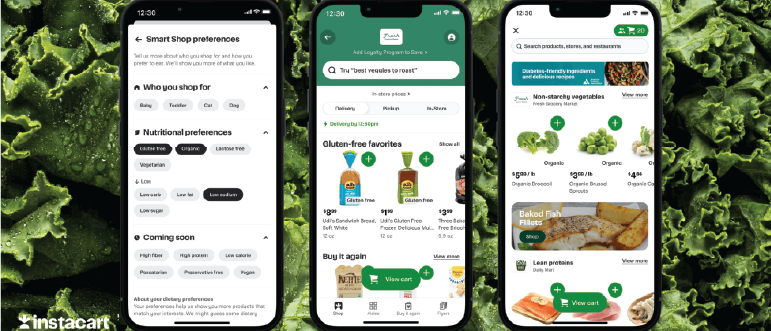

Founded in 2012 by Apoorva Mehta, Instacart started as a San Francisco experiment in crowdsourced shopping. By 2025, it’s a NASDAQ-listed behemoth (CART) with $8 billion in quarterly GTV (gross transaction value), up 15% from 2024. Key milestones shaped its trajectory: The 2020 pandemic boom tripled users to 14 million monthly actives; partnerships with giants like Costco and Aldi expanded reach; and AI integrations like the March 2025 “Smart Shop” program personalized carts with nutritional tweaks.

2025 brought pivotal shifts. The June Storefront update streamlined checkout with simpler designs, boosting engagement. July’s Cart Star refresh raised tier requirements for elite shoppers, emphasizing quality over quantity. September’s Consumer Insights Portal empowered brands with data dashboards, signaling Instacart’s pivot to B2B analytics. Yet, controversies simmer: The May Shopper Agreement tightened deactivation rules, sparking Reddit fears of AI displacement. As CEO Fidji Simo noted in Q2 earnings, “Shoppers are downshifting to value,” with orders favoring budget items amid economic caution.

This evolution underscores Instacart’s adaptability—but also its challenges in balancing user demands with profitability.

For Customers: The Convenience Calculus in 2025

Imagine ditching crowded aisles for a seamless app tap: Groceries from Kroger, Whole Foods, or local independents arrive curbside or doorstep. In 2025, Instacart’s allure peaks with AI-driven features and expanded access, but costs and quirks demand scrutiny.

Why Instacart Wins Hearts (and Saves Hours)

Breadth is Instacart’s superpower. With 85% U.S. coverage and SNAP/EBT enhancements (June 2025 split-cart tool tracks eligibles), it’s inclusive. Same-day delivery in metros, express under two hours—perfect for forgotten dinner ingredients. Nielsen’s 2025 data: Users reclaim 5-7 hours weekly, valued at $250-350 based on average wages.

Standout 2025 innovations:

- AI Smart Shop (March Launch): Analyzes preferences for healthier swaps—e.g., low-sodium alternatives or vegan options. X user @AI__Alexandra switched from DoorDash: “Cheaper, better selection.”

- Instacart+ Overhaul: $99/year unlocks free delivery on $10+ orders (down from $35), 5% pickup credit. Shareable with family; no more service fee reductions post-March, but still saves $7.99/order on average.

- Eco Initiatives: Reusable bags in 20+ markets; curbside pickup cuts emissions.

- Integrations Galore: Loyalty syncing (e.g., Costco Visa), recipe imports from Mealime with shoppable lists.

Testimonials glow: @houseofqllc lauds refunds for mishaps; @snoopsmom123 scores $2.96/dozen eggs via Walmart. For parents, elderly, or remote workers, it’s transformative—Forrester pegs lifetime value at $1,200/year.

The Pain Points: Fees, Substitutions, and Surprises

Paradise has pitfalls. Markups inflate items 15-50%; a $100 in-store cart hits $130-150. Fees: Delivery $3.99+ (free for + on $10+), service 5-10% (no reductions anymore), priority $2-4 for small orders, taxes 1-3%. Tips (10-20%) are encouraged.

Substitutions afflict 25-35%: Wilted produce or wrong brands frustrate. X rants: @agrumpygremlin on broken eggs; @justapieceofsky missing ingredients. Theft cases, like @alexsugarcane’s $1,200 ghost delivery, erode trust. Rural gaps persist at 70% coverage.

Regulatory adds: CA’s Prop 22 surcharges. Consumer Reports audit: $8-15 add-ons for $50 orders.

| Fee Breakdown | Non+ | Instacart+ ($10+) | 2025 Notes |

|---|---|---|---|

| Delivery | $3.99-$9.99 | Free | Express +$4-7 |

| Service | 5-10% ($2 min) | Full rate | Up 2% YoY |

| Priority (<$10) | $2-4 | Waived | New perk |

| Taxes/Reg | 1-3% | Same | State-specific |

| Tips | 10-20% | Same | Impacts priority |

| $50 Order Total Add-Ons | $10-18 | $6-12 | Excl. 15-30% markups |

Customer Case Studies: Real-World Wins and Woes

From X: @kengelo shares family account perks—sisters peek orders for visits. Positive: @relle_laflare’s $100 desk deliveries amuse coworkers. Woes: @CMike7 blasts inventory inaccuracies; @BottleC83823199 cancels after dairy debacle.

Reddit threads echo: One user saved $200/month on bulk via +; another ditched due to 30% substitutions.

Pro Tips to Maximize Value

- Deal Hunt: Toggle in-store prices; stack coupons.

- Order Smart: Recur for 10-15% off; $35+ avoids fees.

- Communicate: Notes like “No subs—text me.”

- Hybrid: Pickup for bulk, delivery for fresh.

- Refunds: 80% resolved via chat.

- Alternatives Check: If fees bite, try Walmart+ ($98/year unlimited).

Worth it? For 2-4 orders/month, yes—nets $500 in time value. Budget-focused? No.

For Drivers: Hustle or Headache in the Gig Economy?

As an Instacart shopper, you’re the human link: Scanning aisles, bagging hauls, navigating traffic. 2025’s 600,000+ workforce enjoys flexibility but grapples with pay dips and algo whims.

2025 Earnings: The Numbers Crunched

Volatility defines pay. Gridwise: $15-26/hour gross nationally, down 10% YoY from saturation. Base $4-10/batch (post-2024 cut); tips $5-12 average; peaks $2-20 bonuses.

2025 Earnings: The Numbers Crunched

Volatility defines pay. Gridwise: $15-26/hour gross nationally, down 10% YoY from saturation. Base $4-10/batch (post-2024 cut); tips $5-12 average; peaks $2-20 bonuses.

Tiers:

- Newbies: $10-15/hour, 2-3 batches.

- Averages: $18-22/hour, $400-600/week (20-30 hours).

- Elites (Diamond, 4.9+ rating): $25-35/hour, $1,200/week in urbans.

Expenses: IRS $0.67/mile shaves 20-30%. Net: $12-18/hour. Reddit: Pre-2025 $25 norm; now hustle for $20.

October’s Rewards Card: Instant payouts, 5-10% gas back. Heavy Pay for bulky orders.

| Earnings Factor | Low | Avg | High | Tips |

|---|---|---|---|---|

| Base/Batch | $4-6 | $7-8 | $9-10 | Multi-store +$2-5 |

| Tips/Order | $2-5 | $6-10 | $12-20 | Chat rapport |

| Bonuses | $0-5 | $5-10 | $15-25 | 80% acceptance |

| Gross/Hour | $10-14 | $16-22 | $25-35 | Multi-app |

| Net (20% Deduct) | $8-11 | $13-18 | $20-28 | EV rebates |

| Weekly (25 hrs) | $250-350 | $400-550 | $600-875 | Peak weekends |

Driver Pros: Flexibility Reigns Supreme

- Schedule Freedom: No bosses; log in for peaks. Great for parents like @poppy4161.

- Easy Entry: Background check, vehicle—start fast.

- App Enhancements: Gas maps save 20¢/gallon; batch previews.

- Perks: Diamond free + membership; community hacks on r/InstacartShoppers.

Camrusselle: “Worth it if >$5/hour”—low bar for side gigs.

The Grinds: Volatility, Toll, and Traps

- Pay Swings: Algo favors vets; tip droughts (30% $0). @kaymooreee quit: “Not worth it.”

- Physical Strain: Heavy lifts, traffic—40% burnout Year 1.

- Deactivations: May contract limits appeals.

- Customer Clashes: Rude notes; mismatches like @MrsJellySantos.

Reddit: $900/week pre-2025; now $15/3 hours. X: @sgt602’s $250/week frustration.

Driver Stories: From the Trenches

YouTube’s “I Tried Instacart in 2025” vlogs reveal hidden strategies: Batch selection key. X: @GigLifeTv on backtracking irritations. Positive: @PatriotMimiG relies on tips but hopes for tax breaks.

Strategies for $20+ Net Hourly

- Zone Wisely: Urbans, weekends 4-8 p.m.

- Ratings Obsess: 100% on-time, photos.

- Expense Track: Mileage logs, Rewards Card.

- Batch Select: Decline <$1/mile.

- Multi-App: Fill with Spark, DoorDash.

- Wellness: Rotate, join unions like Rideshare Drivers United.

Part-time: $500/month easy. Full-time: Diversify or risk.

Instacart vs. Competitors: A 2025 Showdown

Instacart leads grocery variety but lags on fees. eMarketer: 72.5% market share, down from 84.3% in 2020 as DoorDash/Uber catch up.

| Service | Best For | Markup/Fees | Driver Pay/Hr | 2025 Edge | Market Share |

|---|---|---|---|---|---|

| Instacart | Variety/Bulk | 20-40%; $6-12 | $15-26 | AI Smart Shop; 1,500+ stores | 72.5% |

| DoorDash | Speed/Mixed | 15-35%; $4-10 | $18-28 | DashPass; grocery+food | 11.6% |

| Shipt | Quality | 10-25%; $5-9 | $16-25 | Target exclusives; tips | ~5% |

| Amazon Fresh | Prime Ties | 5-20%; Free w/Prime | N/A (W-2) | Whole Foods; drones | 8.0% |

| Walmart+ Spark | Budget | 5-15%; $98/yr | $15-22 | Low fees; EV perks | 7.3% |

| Uber Eats | Global Quick | 20-40%; $3-8 | $20-30 | One ecosystem | 10.9% |

| Postmates (Uber) | Versatile | Similar to Uber | $18-25 | Integrated w/Uber | Merged |

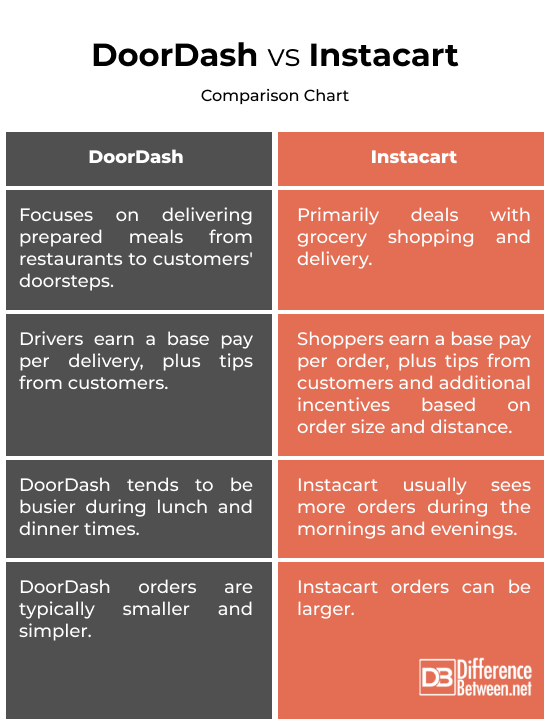

Analysis: DoorDash busier lunch/dinner; Instacart mornings/evenings. Shipt for vetted drivers; Amazon for seamless. Reddit suggests multi-apping: Instacart + DoorDash for $25+/hour. CNET ranks Instacart #4 for cost, #1 variety.

Switch if: Speed (DoorDash), quality (Shipt), budget (Walmart).

Future Outlook: Instacart in 2026 and Beyond

2025 hints at AI dominance: Smart Shop expansions, potential robot shoppers per May Agreement. Q2 growth signals resilience, but gig regulations (e.g., AB5) could hike costs. Predictions: More B2B tools like CIP; drone integrations in urbans; tip tax debates.

For customers: Enhanced personalization. Drivers: Stabilized pay via bonuses, but automation threats.

Final Verdict: Strategic Yes, With Caveats

Instacart in 2025? Worth it strategically. Customers: Time-saver for moderates, saving 10+ hours/month ($500 value) despite premiums. Drivers: $400-800/month supplemental with smarts, but grindy full-time. Diversify, track, communicate.

Your thoughts? Comment: Thriving on Instacart, or eyeing Shipt? Subscribe for gig updates.